These standards dictate how revenue should be measured and reported, considering factors like discounts, returns, and allowances. Under the International Financial Reporting Standards (IFRS), revenue is recognized when control of a good or service is transferred to the customer, which may differ from when cash is received. Some common tactics include increasing sales volume, raising prices, expanding into new markets, or launching new products or services. The key to success is carefully evaluating these strategies to ensure they align with the company’s overarching business objectives and market conditions. A well-planned approach can result in sustainable revenue growth and overall success.

By understanding revenue and its importance, you can gain valuable insights into your business’s financial performance, make informed decisions, and set a solid foundation for sustainable growth. Revenue is often considered the “top line” of a company’s income statement, as it appears at the top and determines the foundation for profitability. In short, revenue is a company’s income generated from its various activities. Choosing which accounting method is largely up to the business and its financial team. Non-operating revenue is income from anything other than the company’s primary source of funds.

A company can actually have a positive revenue whilst having a negative profit. This is because companies have a cost to produce goods, as well as other fixed costs such as taxes and interest payments on loans. This means that if a company’s total costs exceed its revenues, the company will have to take a negative profit. Revenue is the value of all sales of goods and services recognized by a company in a period.

To calculate revenue, you multiply the quantity of products or services sold by the unit price at which they were sold. The result will give you the total revenue generated for the specific period. A company’s income statement shows its revenues and expenses over a certain period, often one fiscal quarter or year.

Gross revenue, or total revenue, is the sum of all money a business generates from its income sources. When calculating gross revenue, accountants and financial analysts include discounts on or returns of products and goods, but don’t take into consideration operating expenses or taxes. Revenue is an accounting term denoting income generated from the sales of goods and services.

In summary, revenue is the total amount of money generated from sales, while profit is the amount of money remaining after deducting expenses from revenue. Both metrics are important for assessing a company’s financial performance and making informed decisions regarding operations, investments, and growth strategies. Revenue is the money an entity brings in from its normal business activities, such as selling its products or services, over a specified period of time, such as a quarter or year.

- Revenue may also be referred to as sales and is used in the price-to-sales (P/S) ratio—an alternative to the price-to-earnings (P/E) ratio that uses revenue in the denominator.

- For the 2025 tax year, those income limits rise to $394,600 for married filing jointly filers and $197,300 for all other taxpayers.

- It’s crucial to consult with a CPA or accounting professional who can provide guidance on the appropriate revenue recognition policies for your business.

- Some straightforward business models can use the “number of units multiplied by cost per unit” formula to calculate revenue.

Gross Revenue

When cash payment is finally received later, there is no additional income recorded, but the cash balance goes up, and accounts receivable goes down. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

A company might have increasing revenue but declining net income due to rising costs. Revenue includes credit sales, which might not represent actual cash inflows, potentially overstating a company’s liquidity. Accrued income is taxable in the year it is earned, while deferred income is taxable in the year goods or services are delivered. So, if a company has a gross revenue of 100 and expenses of 30, its net income would be 70. The difference between gross and net revenue is important to understand because it gives you an idea of how much profit a company is making. Below are two examples of business revenue one for products and one for services.

This is because the form includes everything from employee’s wages, federal income tax to voluntary payroll deductions. This means that the average financial accountant in the United States will have a take-home pay of $4,158 if pre-tax deductions are already taken out of their gross monthly salary. This can change from one company to another, especially considering that not everyone uses the same payroll service. Utilizing companies that offer pay equity services can help provide a good baseline for pre-tax deductions among employees, along with helping them communicate it properly to the rest of the company. ASC 606 simplifies revenue recognition with a clear five-step framework, helping businesses stay compliant and transparent in financial reporting.

What is an example of pre-tax deductions?

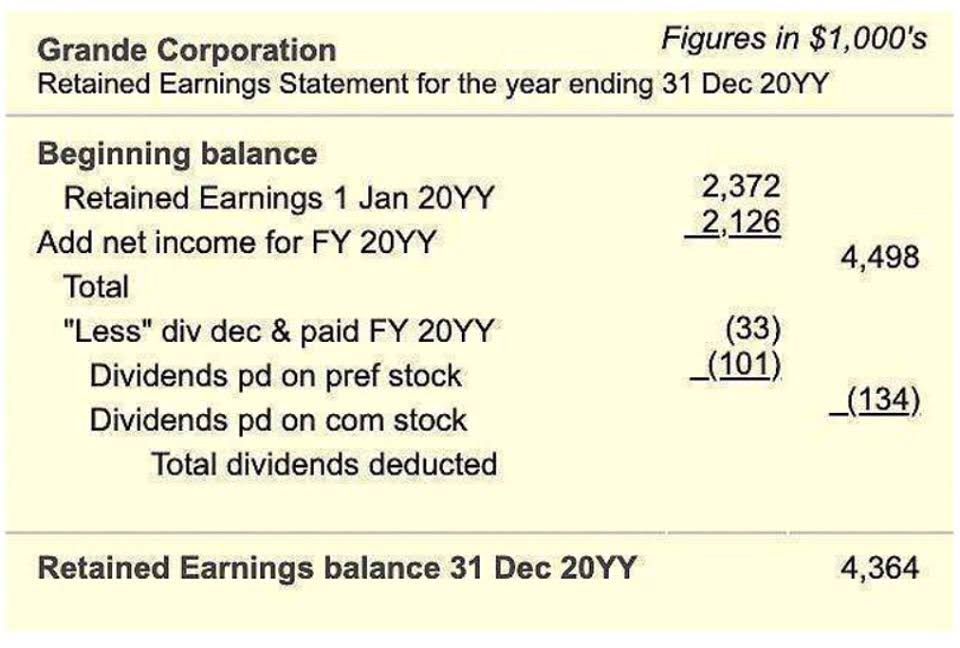

The essential thing is to find what works best for your business and what is considered revenue ensure that you consistently bring in money. The business might have several different revenue streams, but they can be split into operating revenue and non-operating revenue. Donations can come from individuals, businesses or other organisations, and they can be in the form of cash, property or services. It’s doesn’t consist of a cumulative balance of all earnings in the company history. Thus, all prior period earnings must be removed from the account, so the balance only reflects the current year’s earnings.

Subscription revenue example: Software as a Service (SaaS)

In order to help you advance your career, CFI has compiled many resources to assist you along the path. Below, we will explore what the concept of revenue means in different sectors. As you will see, it can be composed of many different things and varies widely in terms of what the most common examples are, by sector. For example, your personal household expense of $1,000 to buy the latest smartphone is $1,000 revenue for the phone company.

- Discounts on the price offered, allowances awarded to customers, or product returns are subtracted from the total amount collected.

- Most states either don’t have income tax or they fully exclude Social Security benefits.

- Discounts are the cost of sale incentives that reduce the selling prices of goods or services.

- However, small businesses or individuals with straightforward operations may choose to use the cash basis for simplicity and ease of record-keeping.

- The key to success is carefully evaluating these strategies to ensure they align with the company’s overarching business objectives and market conditions.

Types of Sales Revenue

Ultimately, it can be complicated to calculate revenue depending on the type of business and the type of accounting. Revenue is one of the many metrics investors look at when deciding whether to invest in a company. Growth stocks, for example, would be expected to rapidly grow their sales, whereas defensive income stocks would be expected to report steady revenues.

ASC 606 codifies clarity and consistency into the revenue recognition process of a business, marking a responsible, nuanced and agile approach to accounting in a complex new age. Census Bureau’s American Community Survey and reported the low- and high-end and median salary of the middle class in New Jersey, with the data. Data is reported based on the Pew Research Center’s definition of middle-class income, which is a person earning two-thirds to double the median income in their state. Hitting that $100,000 threshold once made residents feel comfortable — even « rich » — but that’s no longer the reality.

The key thing to remember is pre-tax deductions’ definition can be the same for payroll deductions. The reduction of take-home income also means that the employees will owe less in income taxes in the long run, which can save more money in the long run. This can help both companies and employees gain better pay equity in the long run as well. Tax deductions are a pivotal part of every employee’s paycheck – after all, the average American tax rate stands at 14.5%. This averages at around $13,890 in taxes paid in 2022, and professionals foresee that the tax adjustments will see a 2.6% increase for the tax year 2025.

However, you need to subtract any discounts, allowances, or returns that may have impacted that revenue number. You need to know how to calculate revenue if you are to analyze it properly. Generally, corporate revenue is subdivided according to the divisions or products that make that revenue. For instance, if you have a restaurant, you might divide and analyze your revenue by categorizing your offerings as sides, main dishes and alcoholic beverages. That’s why you must have a good understanding of what exactly it is. The three main areas that typically make up the finance industry are public finance, personal finance, and corporate finance.

In this section, we’ll look at each major type of disability benefit under federal rules first. A company with high revenue but lagging cash flow might struggle with collecting payments, impacting its ability to meet short-term obligations. Effective credit policies and collection processes can mitigate these risks, ensuring a steady cash inflow to support operational needs. Conversely, a company might experience strong cash flow despite moderate revenue if it efficiently manages its payables and maintains favorable credit terms with suppliers. The principles of revenue recognition focus on the timing and measurement of revenue.

In contrast, assets are relatively stable and can be liquidated or leveraged to support business growth. For instance, a manufacturing company might use its machinery (an asset) to produce goods that generate revenue. This interplay highlights how assets facilitate revenue generation. Therefore, the SaaS company generated $25,000 in subscription revenue for the month. This metric is crucial for the company to track its recurring revenue stream, assess customer retention, and make strategic decisions to drive growth and improve the product offering. Additionally, monitoring subscription revenue allows the company to plan for future scalability and optimize its pricing model to maximize profitability.